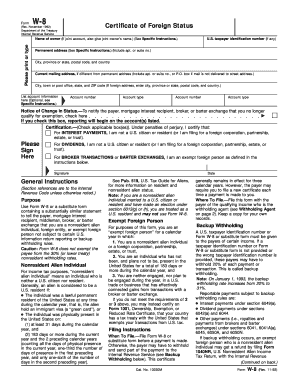

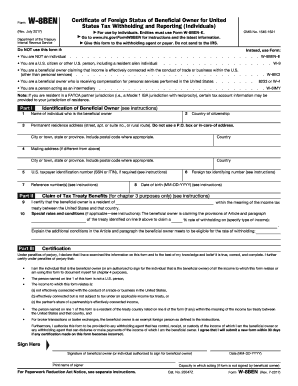

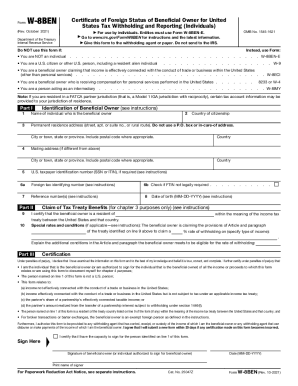

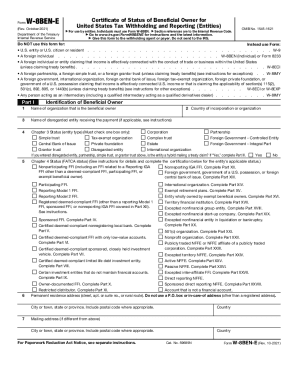

Who needs Form W-8?

W-8 is the US Internal Revenue Service for, that is officially called Certificate of Foreign Status. The filer is a nonresident alien individual, a foreign entity or an exempt foreign person who is not subject to some kind of rules for U.S. information return reporting or backup withholding.

What is the Certificate of Foreign Status form for?

The nonresident alien individuals must fill out the W-8 to inform the payer, mortgage interest recipient, middlemen, broker, or barter exchange of the nonresident or exemption status.

Is the W-8 accompanied by any other documents?

There is no need to attach any other documents to the filled out W-8. However, to submit the Certificate form foreign persons who receive income from a business operating in the US must obtain a TIN. It can be requested via forms SS-4 or SS-5, they can be taken at local IRS office or local SSA office correspondingly.

The withholding agent must file form 1042S. Further, forms W-8 and 1042S are to accompany form 1042, which is Annual Withholding Tax Return for U.S. Source Income of Foreign Persons.

When is the W-8 form due?

It is important to submit the completed Certificate of Foreign Status before nonresident alien individual makes the payment. The W-8 form should remain in effect for three years.

How to fill out the W-8 form?

The W-8 form is a two-page form, the bigger part of which is the comprehensive instruction to follow.

The following information is required in order to file the Certificate of Foreign Status:

- The owner’s name and permanent address;

- Information about the owner’s account;

- The alien’s certification.

Where to send the completed W-8 form?

The filer must deliver the completed W-8 to the (payer) of the qualifying income who acts as the withholding agent. It is important that the filer retains a copy of the W-8 for their private records.